Light Industries

Light Industries

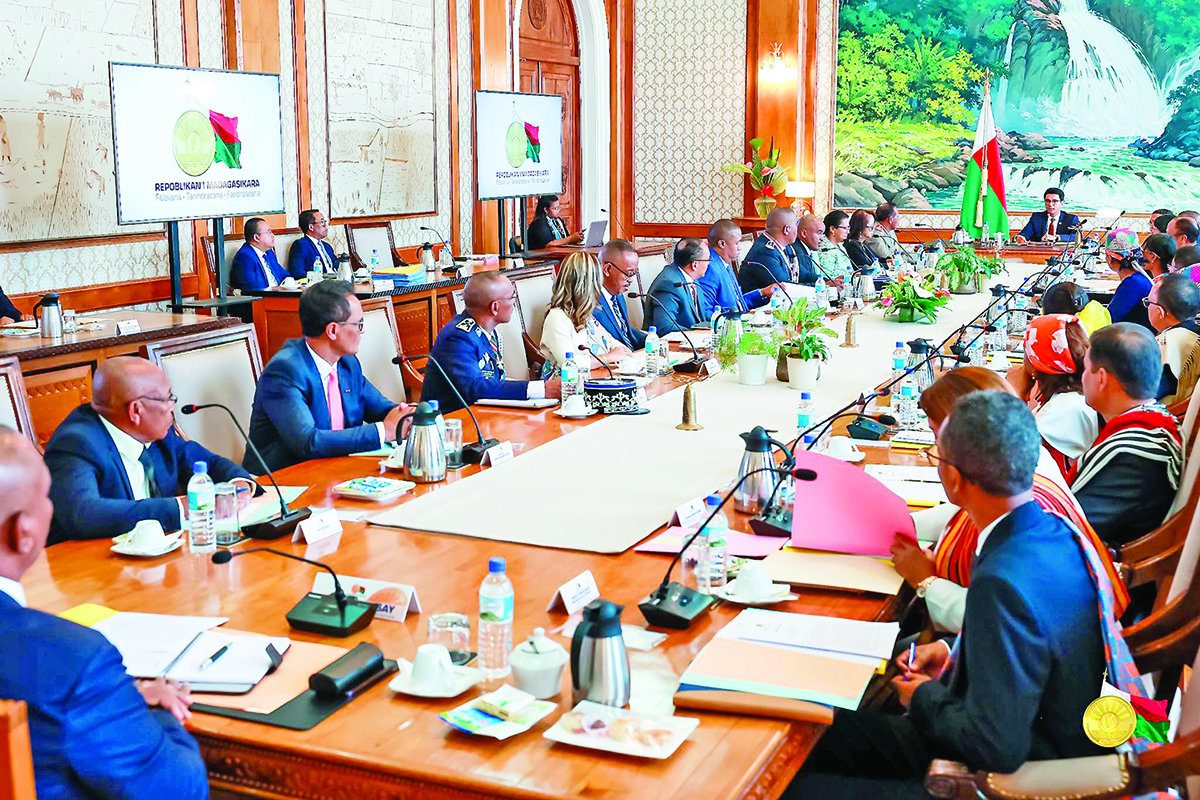

Madagascar, another industrial revolution

MADAGASCAR, strategically located in the Africa-Asia axis and with a highly skilled workforce, is the ideal destination for any project in light industry.

Industry contributed to 19% of GDP and this sector is beginning to recover. It is evidenced by the quality and reputation of products manufactured in Madagascar distributed across the global market.

Madagascar has several assets for the development of this sector:

- Important supply base of local resources for the development of world-class spinning and weaving operations, products based on plant fiber or other processed products of plant and / or animal origin, …;

- Competitive labour costs: USD 70/month, for example, for clothing manufacturing;

- Recognized competence: highly skilled labour force with a reputation for exceptional dexterity and productivity;

- Interesting geographical location close to other business platforms in Mauritius and South Africa, thus facilitating access to expertise, inputs and logistical support for export;

- Port infrastructures (Toamasina, Port of Ehoala …) and airports (Antananarivo, Nosy Be, Taolagnaro …) facilitating shipments;

- Preferential access to regional and international markets (AGOA, COMESA, IOC, EBA/EPA, …);

- A pool of potential partners such as representative and effective professional groups and associations (GEM, SIM, GEFP, FIVMPAMA, FCCIM, CCIFM, …);

- Incentive regime for Free Zones and Enterprises with tax and customs exemptions.

The industrial sector in Madagascar is largely dominated by businesses under the Free Zones and Enterprises regime. A special incentive regime for export-oriented activities such as textile, agribusiness and ICT-related jobs. Over one third of all jobs created in the industrial sector are in businesses benefiting from the scheme. Albeit highly-export oriented, local market tends to develop with the emergence of the middle class.

Some figures

- About 225 companies in light industry are licensed as tax-free businesses

- About 35% are members of private sector groups.

Legal framework

- Law No. 2007-037 of 14 January 2008 Directory of Free Zones and Companies in Madagascar

- Export of at least 95% of production

- Income Tax Exemptions

- 15 years for free zones, then 10%

- 5 years for processing companies, then 10%

- 2 years for service companies, then 10%

- Customs and VAT exemptions for imports